In August, New Jersey Generates $53.3 Million in Gaming Taxes

In August, New Jersey Generates $53.3 Million in Gaming Taxes

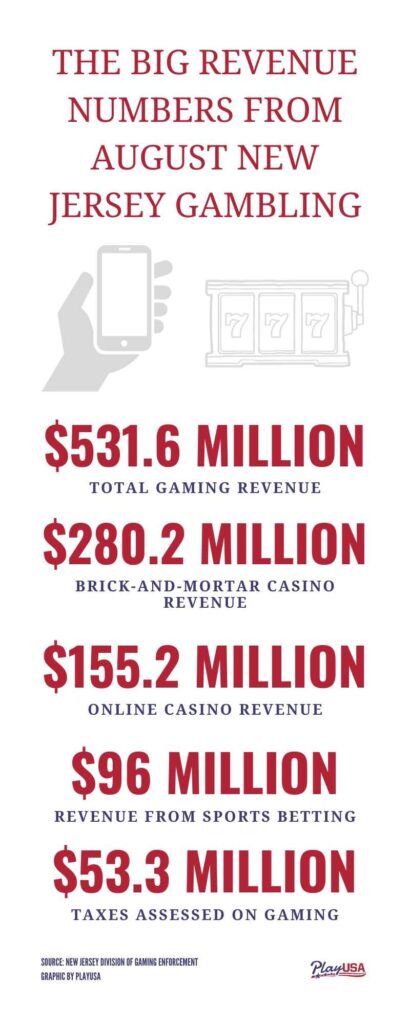

New Jersey’s gaming industry has once again proven to be a significant revenue generator for the state, as it reported a staggering $53.3 million in gaming taxes for the month of August. This figure highlights the continued growth and success of the state’s gambling sector, which has been steadily increasing over the past few years.

The gaming industry in New Jersey has experienced a remarkable resurgence since the legalization of online gambling in 2013. This move not only revitalized Atlantic City’s land-based casinos but also opened up new opportunities for online operators. The combination of traditional brick-and-mortar establishments and online platforms has created a thriving gambling ecosystem that attracts both local and international players.

The $53.3 million in gaming taxes collected in August represents a 31% increase compared to the same period last year. This surge can be attributed to several factors, including the ongoing recovery from the COVID-19 pandemic, increased tourism, and the popularity of online gambling.

The COVID-19 pandemic had a significant impact on the gaming industry worldwide, forcing many casinos to temporarily shut down or operate at reduced capacity. However, as restrictions eased and vaccination rates increased, New Jersey’s casinos were able to bounce back quickly. The reopening of these establishments, coupled with pent-up demand from eager gamblers, contributed to the impressive tax revenue generated in August.

Furthermore, New Jersey’s tourism industry has experienced a resurgence as more people feel comfortable traveling again. The state’s beautiful beaches, vibrant nightlife, and world-class entertainment options have always been a draw for tourists, and the allure of its casinos adds another layer of attraction. As visitors flock to Atlantic City and other gambling destinations, they contribute to the overall growth of the gaming industry and subsequently generate higher tax revenues.

Another crucial factor in New Jersey’s gaming success is the popularity of online gambling. The state was one of the first in the United States to legalize and regulate online casinos and sports betting, allowing residents and visitors to enjoy their favorite casino games from the comfort of their homes. The convenience and accessibility of online gambling have proven to be a game-changer, attracting a new demographic of players who may not have otherwise visited a physical casino. The tax revenue generated from online gambling has been steadily increasing, further bolstering the state’s overall gaming tax figures.

The $53.3 million in gaming taxes collected in August will undoubtedly have a positive impact on New Jersey’s economy. These funds can be allocated towards various initiatives, such as infrastructure development, education, healthcare, and social programs. Additionally, the gaming industry itself provides employment opportunities for thousands of individuals, further contributing to the state’s economic growth.

As New Jersey continues to thrive in the gaming sector, it serves as a model for other states considering the legalization of online gambling. The success of the state’s regulated market demonstrates that a well-regulated and properly taxed gambling industry can be a significant source of revenue and economic stimulation.

In conclusion, New Jersey’s gaming industry has once again showcased its strength by generating $53.3 million in gaming taxes for the month of August. This remarkable figure is a testament to the resilience and growth of the state’s gambling sector, fueled by the recovery from the COVID-19 pandemic, increased tourism, and the popularity of online gambling. As New Jersey continues to reap the benefits of its thriving gaming industry, it sets an example for other states looking to tap into this lucrative market.